Is There A Tax Credit For Central Air Conditioners

A cooling efficiency of greater than or equal to 16 SEER and 13 EER. Heating Ventilating Air Conditioning HVAC As much as half of the energy used in your home goes to heating and cooling.

American Standard Air Conditioner Reviews Prices 2021

Those credits were renewed by the US.

Is there a tax credit for central air conditioners. In order to receive a tax credit of 300 the air conditioning system must meet the following criteria. Here are the federal tax credits for heating and cooling equipment in 2020. Rebates for new air conditioners are used to primarily promote high energy-efficient air conditionersHere are just some examples of rebates you can get for new AC units in 2021.

The credit for the heat pumps was 30 percent of the cost. Central air conditioning Air conditioners recognized as ENERGY STAR Most Efficient meet the requirements for a 300 tax credit. Gas Boilers.

Here are some tips and tricks for getting a tax credit when you install a new unit. As of January 2021 the program was retroactively. ENERGY STAR Products That Qualify for Federal Tax Credits.

Meeting the requirements though is the condition of receiving this tax credit. The Non-Business Energy Property Tax Credits have been retroactively extended from 12312017 through 12312021. The following types of equipment qualified for the HVAC tax credit in 20162017.

There is a tax savings of up to 150 for propane natural gas and oil furnaces and boilers. Under this new tax law you can offset the cost of a whole new HVAC system for up to 5000 or more. This means that certain qualifying air conditioners and heat pumps installed through December 31 2021 are eligible for a 300 tax credit.

Government in December 2019. The final expense can only be determined after receiving an estimate for the cost of installation ductwork or other installation items that are needed. With some luck you dont have to pay the full price for an air conditioner.

This includes heat pumps central air systems boilers water heaters and more. The 25C tax credit includes. 10 of cost up to 500 or a specific amount from 50-300.

Its not all bad news for consumers who. Air-source heat pumps Heat pumps that are ENERGY STAR certified qualify for a 300 tax credit. There is a new tax law that allows business owners to immediately expense their air conditioning heating and ventilation system.

Reimbursement of up to 10 of the cost up to 500. Air to Air Heat Pumps. Larger commercial systems will have an even more substantial value.

The cost of a new central air-conditioning system can run between 500-4000. In 2020 the government extended the previously-expired Non-Business Energy Property Tax Credits on residential air conditioning equipment. Energy Star US Department of Energy.

There are two possibilities. Certain heat pumps also qualify for a tax credit of 300. First if you itemize deductions and you choose to deduct state sales taxes as opposed to the state income tax then you can include the sales tax on a major item like the new air conditioning unit.

There are no tax credits for efficient HVAC equipment other than geothermal. Gas propane or oil boilers Gas powered boilers. Must be an existing home your principal residence.

Please click on the Tax Credit Certificate below for additional information and to determine if your model qualifies. How to File Taxes Online Using HR Block When you file with HR Block Online they will search over 350 tax deductions and credits to find every tax break you qualify for so you get your maximum refund guaranteed. Please click on the Tax Credit Certificate below for additional information and to determine if your model qualifies.

Having a solar-ready heat pump or air conditioner installed in your home before December 31 2021 may qualify you for a federal tax credit of up to nine percent of the equipments cost. And thats just on an average-sized system. Advanced Main Air Circulating Fan Indoor Blower Motors SOURCE.

If your home system meets the requirements a tax credit consisting of 30 percent of the cost up to 1500 is in order. Based on the component purchased and installed homeowners receive a tax credit in either a percentage of the cost up to 500 or a fixed amount from 50 to 300. Now as of January 15 2021 the Tax Credit has been extended again.

SEER 16 EER 13. SEER 14 EER 12. Im not going to lie to you there are some specifics you need to be aware of.

Every year there are 100s of rebates for new air conditioner units and 2021 is no different. The only HVAC tax credits for 2019 are for geothermal heating and air conditioning. Advanced Main Air Circulating Fan.

A cooling efficiency of greater than or equal to 16 SEER and 13 EER. Second you may qualify for the Residential Energy Credit. Equipment Tax Credits for Primary Residences.

However knowing whether or not you will qualify can get a bit tricky. HVAC Tax Credits vs HVAC Rebates. So making smart decisions about your homes heating ventilating and air conditioning HVAC system can have a big effect on your utility bills and your comfort.

Tax Credits on Solar Energy Through 2021. Federal Tax Credits. If you have an air conditioning system in your home you may be eligible for a federal tax credit.

Thanks to the tax credit homeowners will receive a credit against their taxes for an amount equal to 10 of the amount paid or incurred up to 500 or a specific amount from 50 300. A credit of up to 300 is available for central air conditioners packaged units heat pumps and ductless mini-split systems. HVAC systems have a fixed amount of 300.

The 25C tax credit for high-efficiency heating and cooling equipment was renewed in December of 2019. HVAC 25C tax credits are available for high-efficiency heating and cooling equipment. It just makes sense to take advantage of the 300 maximum credit the IRS allows for energy-efficient AC units.

To ensure that you claim all the energy tax credits that you are eligible for we recommend filing your taxes with HR Block online this year. Or a specific amount from 50. There may be some tax credits waiting for you during 2014 if you choose to install a new air conditioner this year.

Theres also an additional credit available on the solar module used to generate electricity for your new HVAC components. There is a tax credit available for the purchase and installation of heating ventilating and air conditioning HVAC equipment. Here are some of the efficiency requirements for air conditioners and heat pumps.

The credits for efficient equipment ran out at the end of 2016 and were not renewed in the Bipartisan Budget Act of 2018.

/filters:quality(60)/2020-12-04-How-Much-Does-It-Cost-to-Install-Central-Heat-and-Air-CDN.png)

How Much Does It Cost To Install Central Air And Heat Ownerly

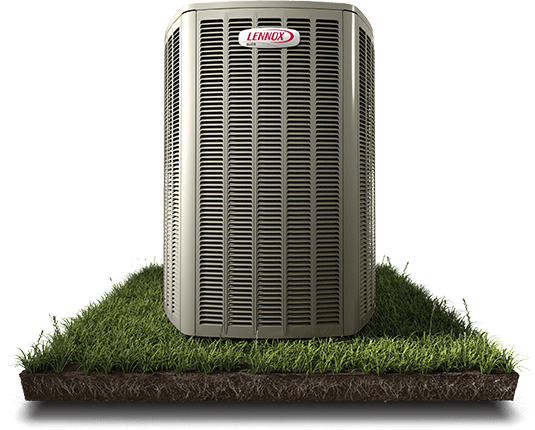

High Efficiency Home Air Conditioner Lennox El16xc1 Elite Series

Rheem Central Air Conditioners 2021 Buying Guide Modernize

Why Is There Ice On My Air Conditioner Reddi Hvac

How Much Does An Air Conditioner Furnace Combo Cost

How Much Does A Central Ac Unit Cost The Cost To Install Central Air Broken Down

Extended 300 Federal Tax Credits For Air Conditioners And Heat Pumps Symbiont Air Conditioning

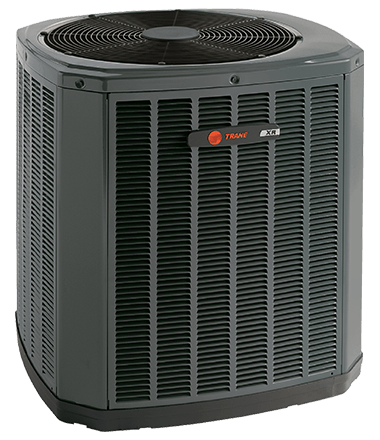

Trane Xr16 Air Conditioner Best Rebate Prices Now

2021 Central Air Conditioner Costs New Ac Unit Cost To Install

Furnace Air Conditioner Combo Prices 2021 What Is The Cost Of Hvac System Replacement

Mrcool Signature Series Heat Pump Package Residential 4 Ton 14 Seer Central Air Conditioner In The Central Air Conditioners Department At Lowes Com

Hvac Upgrades That Qualify For Tax Credits Air Assurance

/cdn.vox-cdn.com/uploads/chorus_asset/file/22449178/AdobeStock_86087795.jpeg)

How Much Does An Air Conditioner Cost This Old House

Bryant Air Conditioner Reviews Prices March 2021

Should I Repair Or Replace My Air Conditioner New Ac Cost

Rheem Air Conditioner Prices Installation Cost 2021

Ruud Central Air Conditioner Reviews And Prices 2021

Goodman Air Conditioner Prices Installation Cost 2021

How Do I Find Out How Old My Ac Is First Choice Heating Cooling

Posting Komentar untuk "Is There A Tax Credit For Central Air Conditioners"